I’m proud to introduce the inaugural Supply Chain Corner column, which harkens back to Concentric’s mantra, Finding a Better Way. That mantra, created in 2000, has never changed, because we believe in constant improvement. That’s why we plan to use this forum to explore supply chain issues and keep finding better ways together.

On to the first post!

What do we do when our consumers’ behavior changes overnight?!

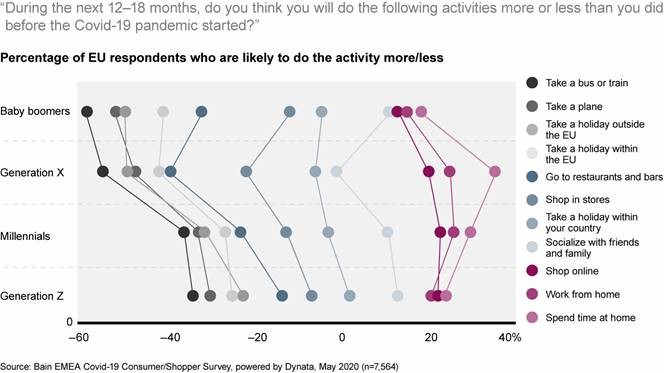

Bain & Company just came out with their opinion/findings on overnight consumer changes which they are calling “The Great Reluctance.” Figure 3 highlights how different generations indicate they’ll have different consuming patterns over the next 18 months. The only thing most believe WON’T change much: in-country vacation travel. (I’d concur - we just took our kids to the beach to release them from lockdown for a few days!)

A challenge to the WHY of this data:

- Is it (as the article implies) simply due to anxiety/fear of catching the virus?

- is it because we’ve entered a huge recession and many of us are now out of work and know/plan to consume less to make it through these trying times?

- Is it – at least in part – because this brief period of changed behavior has resulted in long-term behavior modification, perhaps for reasons other than the virus?

Probably ALL OF THE ABOVE!

That said, Bain highlighted that “CruiseCompete.com has reported a 40% increase in bookings for 2021 with 2019.” That doesn’t fit with the above cleanly—lots of grey area here. Change is happening, we all know it. What are we going to do about it? Here’s an immediate AND ongoing strategy to consider:

Be omni-channel-ready at both a supply chain/distribution and sales level. Have a team always building out new channels/approaches on reaching end consumers.

Here’s a hypothetical example:

70% of food purchases are made in restaurants. As we saw, almost overnight, restaurant eating ceased. An omni-channel ready fishery/distributor could have executed one or more of the following:

-

Shift Hard to Grocers - Made sure they could meet rising demand at all grocers, Costcos, boutique online delivery/ecommerce sites. As grocery stores faced shortages across many items, simply being in-stock at fish counters and in freezer cases makes purchase more likely.

-

Go Direct to Customer (D2C) – If they already had their own ecommerce site with last-mile delivery available, they could double down on adwords, promoting online, etc

-

New Business Development - Call on Blue Apron and other food prep companies, including grocery chains like Trader Joe’s and FreshDirect, which have popular prepared meal segments. Work with them to ramp up fish offerings. Help them design some online trainings and demos.

-

Promote - Go to Netflix, Youtube, etc and make sure you’ve got shows promoting HOW to cook fish and the nutritional benefits. An influencer campaign across platforms could be an effective way to reach new audiences AFTER you’ve made sure any availability issues are resolved so that consumers aren’t frustrated.

-

Support Restaurants – Identify which types of restaurants are making it work through the hard times (“fast casual” examples like Zoe’s and Chipotle come to mind) and reach out to them. Figure out if there are any ways you can meet changing demand/needs they have for product, pricing and distribution.

This probably won’t make up 70% of the difference, but could be significant and would make you a more “anti-fragile” company in the future. Focus on identifying and then solving problems both for your channel partners (out of stocks) and end customers (more ways to access your products the way they want).

Join us next time when we examine another supply chain issue and explore ways to overcome it!

Ryan Lynch

Ryan Lynch